Blog

Blog

Treasury-as-a-Service: A New Operating Model in Corporate Treasury?

For a long time, the corporate treasury function has been clearly an internal, in-house area of responsibility. Cash management, managing banking relationships, …

February 1637: When the Tulip Bubble Burst – A Mid Office & Risk Perspective

In February 1637, the Dutch Tulip Mania collapsed in a matter of days. What began as a fascination with rare and exotic …

How did the market perform in the transition process?

By end of June 2023, all LIBOR settings ceased, effectively marking the full transition to the new alternative reference rates like SOFR, …

FX Risk Management: Why It’s a Key Issue for Hungarian Companies

Hungary has an extremely open economy: in 2024, exports accounted for nearly 75% of GDP, while imports reached 82%. In such an …

When Is the Right Time to Invest in a Treasury Management System?

This is a question we often hear when talking to corporate finance managers. Naturally, there is no single formula that works for …

Case studies for Corporate Market Risk Management – Risk Management of Imports

For businesses with import need, managing foreign exchange (FX) risk is paramount. This risk is typically borne by the buyer. While various …

Corporate treasury challenges and main priorities 2025

With over 20 years of experience in developing treasury management software for banks, our company has recently expanded into the corporate treasury …

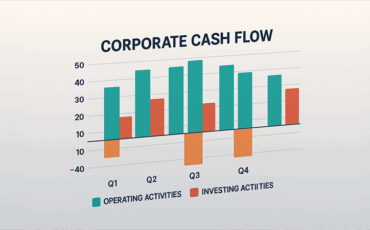

Establishing the Connection Between Business Planning and Cash Flow Planning

When we spoke with CFOs and treasury managers, they identified the lack of access to necessary information as one of the biggest …

Free Webinar

Beyond IBOR: Key Learnings and Practical Applications in Treasury and Back Office Operations …

EMIR REFIT

We gave a presentation on the EMIR REFIT amendments, covering the current changes and requirements to help market participants to develop more …

Innovation in Software Testing

Innovation in software testing – Is automation the solution? …

Automated Stress Testing

The aim of our study is to investigate whether an automated software testing system can provide a solution for efficient and accurate …

BLOOMBERG & FX SOFTWARE

Bloomberg & FX Software joint webinar in treasury innovation topic: possible use of artifical intelligence in the everyday activity of the sales …