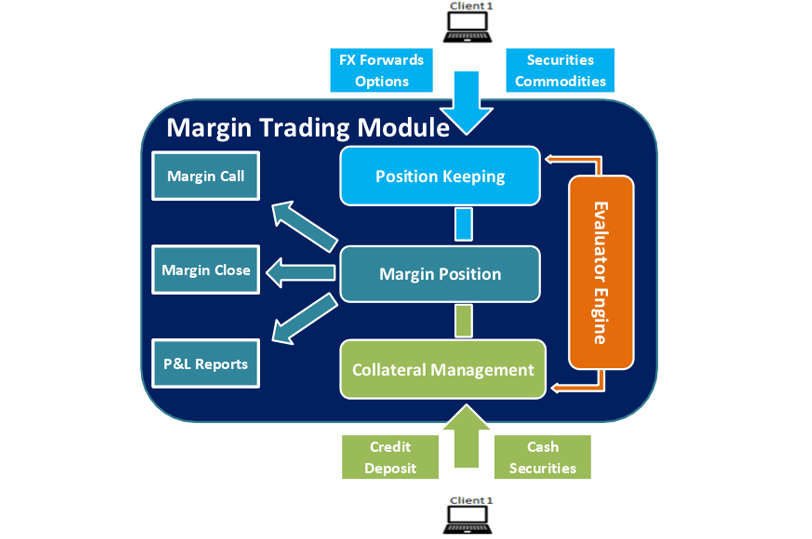

InFoRex Margin Trading Module

Introduction

InFoReX supports treasury sales activity, among others, with its Margin Trading Management function. This function manages customer positions (resulting from FX deals and orders), registers and evaluates related covers and handles the operation process of opening & closing FX deals.

Collateral Management

InFoReX supports collateral management through the Account Maintenance screen. This surface enables the registration and market evaluation of the client’s collaterals. The accounts can be distinguished by the usage of the collaterals (position types: e.g. collateral for FX margin trading transactions, State Bonds margin trading, etc.). Collaterals can be credit, deposit and cash type, and InFoReX is also able to handle securities.

Margin Position

The heart of the system is the position keeping tool, which provides real-time and accurate position valuation. Our powerful evaluator engine is a market leading solution. It not only offers a general valuation method, but also handles complex interest curve transformations and is able to replicate any valuation model.

Real-time valuation of margin positions are summarized by clients and matched to the registered collaterals. As collaterals are also monitored and evaluated on a daily basis, the margin position is a precise result of the client’s exposure and settled covers on its account.

Closing Position

The system supports full or partial closing of positions. Closing deals can be paired with the open positions on our client’s Margin Pairing Screen. InFoReX also supports early termination or prolongation tasks by position matching.

Margin Call

According to the margin call rules, the system can send margin call and margin close notifications, with details about the required incremental collateral in case of insufficient cover amount. Margin open levels can be also set, i.e. entry level of the collateral in case of new deals.