How did the market perform in the transition process?

How did the market perform in the transition process?

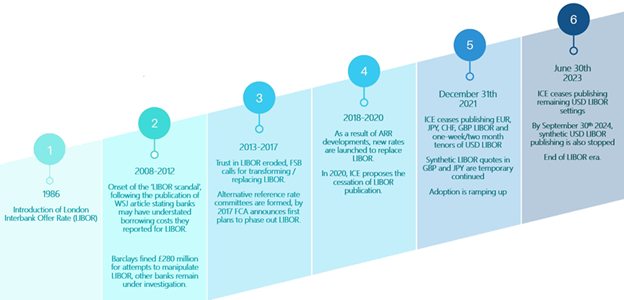

By end of June 2023, all LIBOR settings ceased, effectively marking the full transition to the new alternative reference rates like SOFR, SARON, SONIA and ESTR.Considering the enormous notional volume – estimated at around USD 400 trillion – and wide range of products (loans, mortgages, bonds, derivatives) once linked to LIBOR, the transition has been the most significant challenge in decades for global financial markets.

To facilitate the transition and address the backward-looking nature of the new ARRs, several forward-looking term rates have been developed in recent years. Today, more than 4 benchmark administrators publish such rates, and some have been explicitly endorsed by regulators: for example, CME Term SOFR for USD markets and ICE Term SONIA for GBP markets. However, these term rates are generally recommended only for use in cash products under new contracts, such as loans and trade finance.

The markets have largely adapted to the post-LIBOR environment, with the transition essentially complete, apart from some small-volume, retail-focused “tough legacy” contracts. As an example, let’s look at USD Swaps volume (single-sided gross notional in USD millions), where LIBOR linked IRS volume went down to $0.48 trillion, from $9.3 trillion and $62 trillion in prior years, showing clearly the end of LIBOR, with zero volume from August 2024 onwards.